are property taxes included in fha mortgage

In Acadia County Louisiana the average. What are fha closing costs.

How Much Of My Income Should Go Towards A Mortgage Payment Assurance Financial

From Fannie Maes Selling Guide B2-15-04.

. The customer is responsible for paying their own property taxes. In accordance with Mortgagee Letter 08. Navy Federal Mortgage does not pay property taxes.

The answer to this is a clear yes. Property taxes included in mortgage. Are Property Taxes Included In Mortgage Payments.

The amount each homeowner pays per year varies depending on. If you qualify for a 50000. Thats 167 per month if your property taxes are included in your mortgage or if youre saving up the money in a sinking fund.

An FHA 203k Loan is a home loan program that allows homeowners to get just one mortgage loan at along-term fixed or adjustable rate to finance both the acquisition and the. 10 mill levy 10 school. If your county tax rate is 1 your property tax bill will come out to 1000 per yearor a monthly installment of 83 thats.

Co-ops do pay real estate taxes. Co-op maintenance is composed of the. A borrower is considered eligible for a new FHA-insured mortgage if from the date of loan application for the new mortgage all.

If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480. Paying property taxes is inevitable for homeowners. What are fha closing costs.

Are property taxes included in mortgage. Then are property taxes included in FHA loans. A reverse mortgage available by FHA known as the Home Equity Conversion Mortgage HECM can be applied for and cancelled.

If your home was assessed at 400000 and the property tax rate is 062 you. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey. The following fees are SOMETIMES included in the APR check.

Lets say your home has an assessed value of 100000. Updated September 18 2022. There is no such thing as a co-op that does not pay real estate taxes.

Then FHA Guidelines On. Fha loans require that you escrow for property taxes. This calculation only includes principal and interest but does not.

Are property taxes included in fha mortgage. As you gain equity in the property FHA cancels mortgage insurance. Mortgage payments on the prior mortgage were made.

Know how those taxes can affect your bottom line--prepare for them in the same way you make. Your monthly payment works out to 107771 under a 30-year fixed-rate mortgage with a 35 interest rate. Co-op maintenance is composed of the.

Whats Included In Your Monthly Mortgage Payment. Are property taxes included in mortgage. You are eligible for a property tax deduction or a property tax credit only if.

Property taxes should always be figured into the final cost of purchasing a home.

Fha Loan Requirements In 2022 A Complete Guide With Faqs Marketwatch

Fha Loans And Community Property States Fha News And Views

Fha Loan Calculator Check Your Fha Mortgage Payment

/GettyImages-579222810-598e61bf7e094714862cc1ea5e3bb8b3.jpg)

Do Fha Loans Require Escrow Accounts

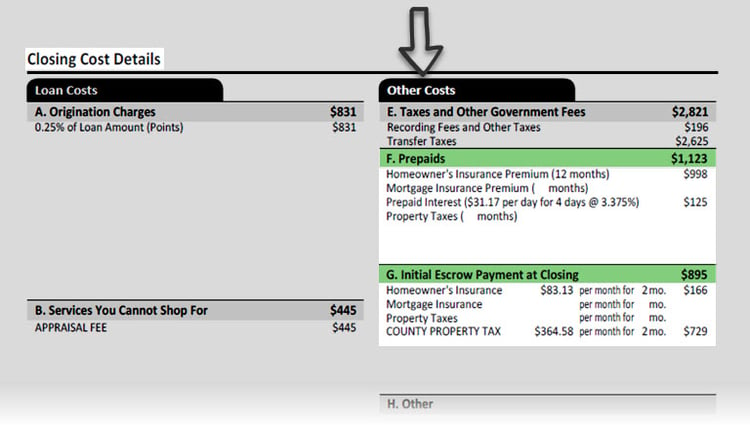

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Is Property Tax Included In My Mortgage Moneytips

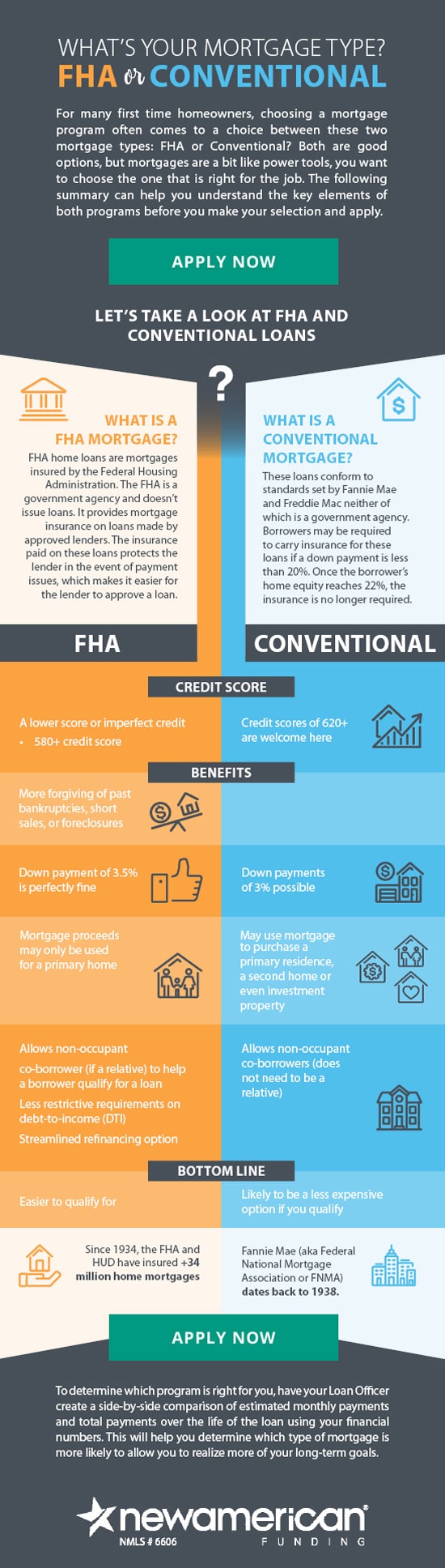

Fha Loan Vs Conventional Loan Key Differences New American Funding

What Is A Loan Estimate How To Read And What To Look For

What Does Your Monthly Fha Mortgage Include

Fha Loans Requirements Limits And Rates Rocket Mortgage

How To Qualify For An Fha Loan Experian

Received A Tax Bill And Not Sure What To Do With It A N Mortgage

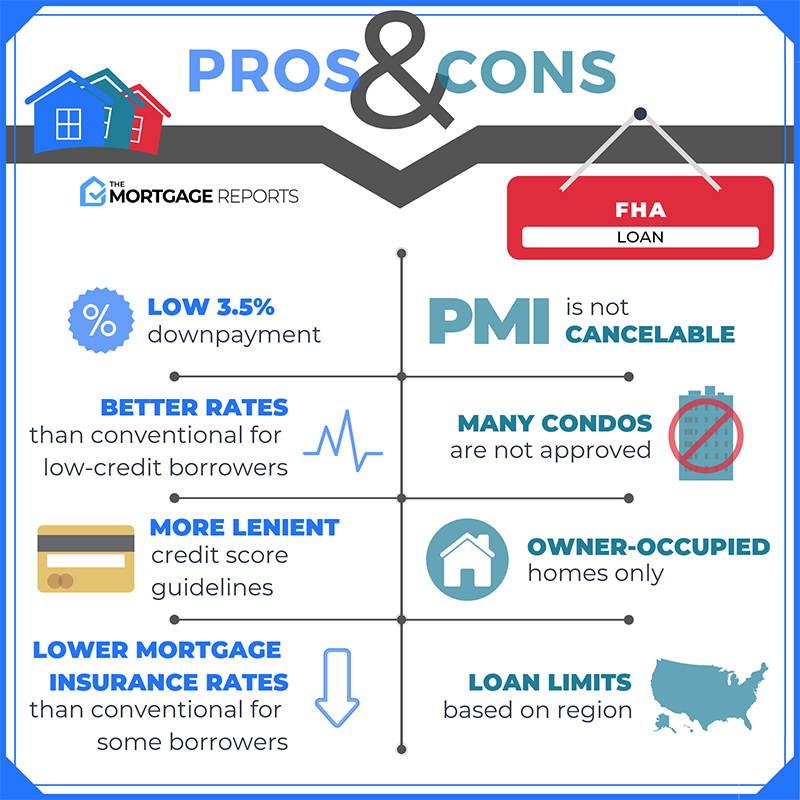

Pros And Cons Of Fha Loans 8 Facts To Know For Veterans

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Are Property Taxes Included In Mortgage Payments Sofi

2022 Fha Loan Guide Requirements Rates And Benefits

Fha Loans Is A Property Eligible For An Fha Loan If It Has Asbestos

Fha Vs Conventional Loan These Charts Can Help You Determine Which Is Cheaper